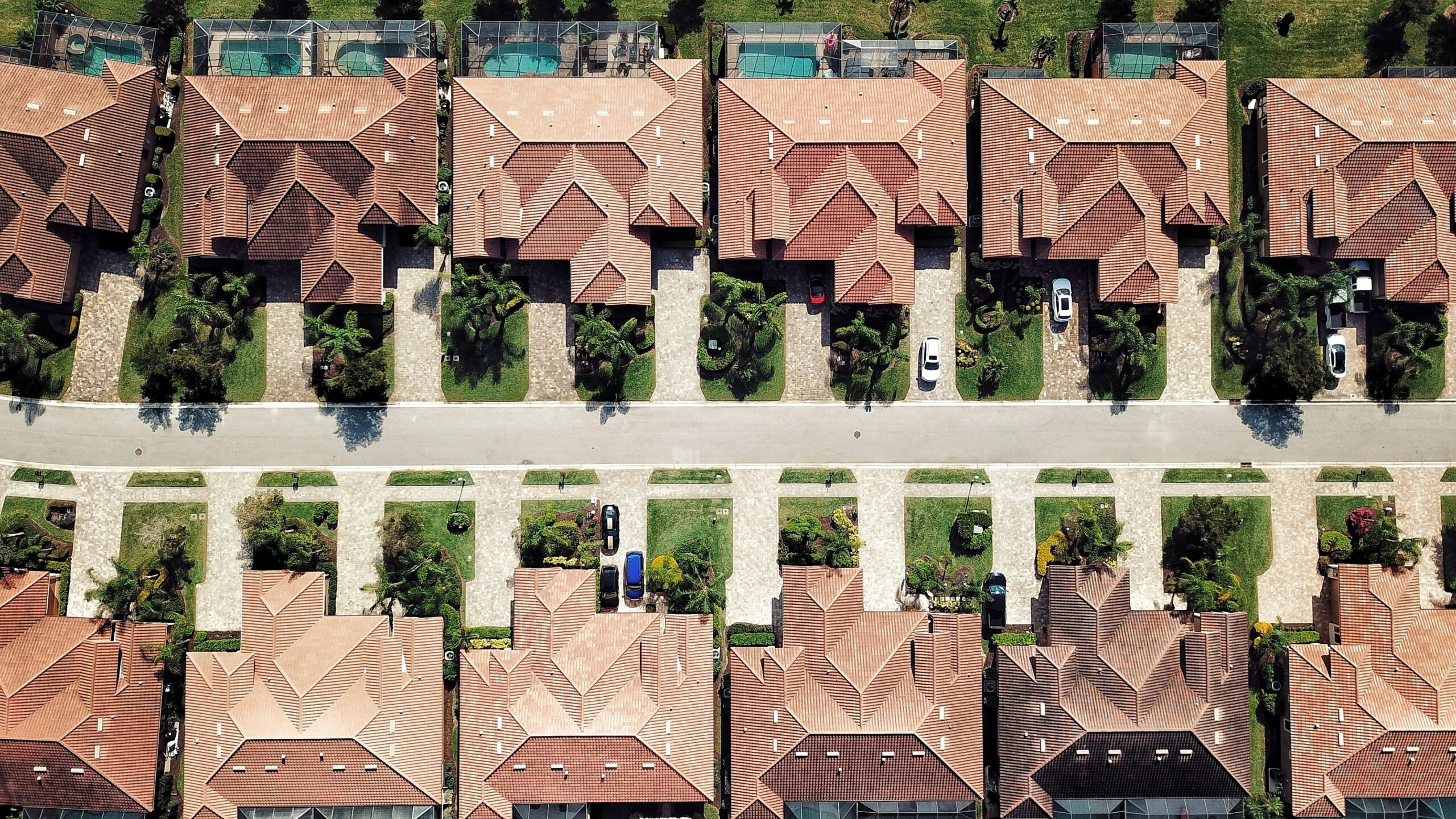

Real Estate Investing

Florida Land Trusts Provide Liability Protection

In recent weeks and months, we’ve been diving into the many benefits of a Florida land trust. These trusts provide great flexibility and privacy to those involved, but they also add an extra layer of protection for the beneficiary of the land trust.

Can You Place a Homestead in a Land Trust in Florida?

One of the biggest questions surrounding Florida land trusts is whether or not you can put your own home in one. Land trusts provide an element of privacy and additional flexibility for those who are managing and transferring real estate. There are some who have questioned whether or not homesteads should be permitted inside of land trusts because of Florida’s homestead exemption.

Does Florida Allow Land Trusts?

The simple answer to whether or not Florida allows land trusts is yes, the state absolutely allows you to set up land trusts. Whether you’re an individual, a family, or a real estate investor, you have access to the many benefits of a Florida land trust. What’s important to understand is that some states don’t have specific laws or statutes addressing land trusts which can make the process more complicated.

Differences Between a Land Trust and a Living Trust

Estate planning can be a complicated subject, especially for people who own multiple properties and want to secure them all. Land trusts are not the same thing as living trusts. It’s important to understand the differences – because you can hold property in a living trust without fulfilling the same goals as a land trust.

Limited Partnership vs. LLC For Real Estate Investments

LPs used to be one of the most common ways companies would raise money from investors, but the advent of the LLC entity structure has put Limited Partnerships on the backburner. There are some strong similarities between the two structures, but a few distinct and important differences show why more investors opt for LLCs today.