Let’s face it – we all take the easy way out from time to time. Sometimes the easy way is the right way and other times it’s just more convenient for our lives at that moment. When it comes to your business, however, it’s imperative to take whatever avenue that best protects your assets and preserves future growth.

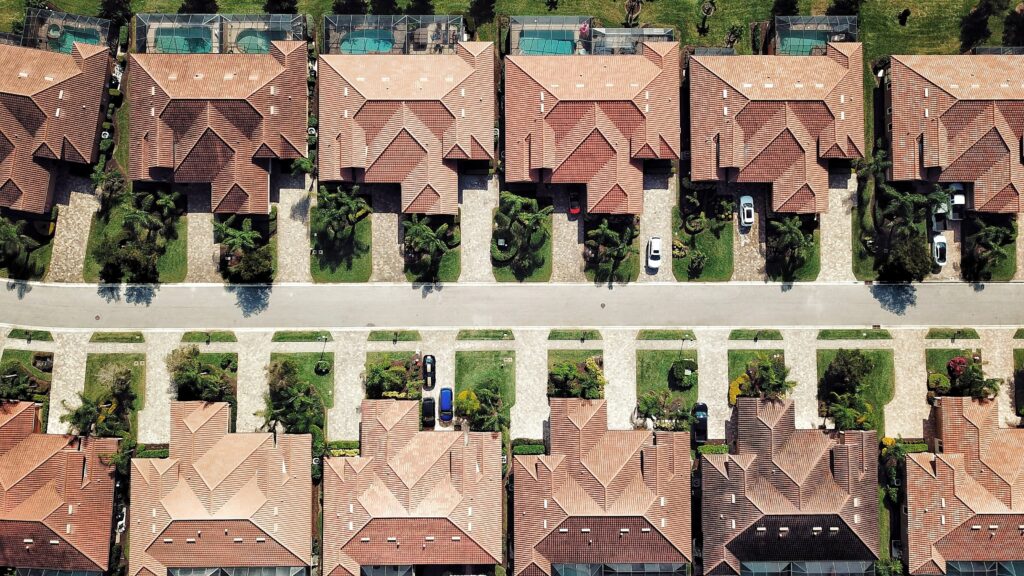

Real estate presents incredible opportunities to make a living, especially in the Sunshine State. However, you’re limiting your opportunities if you simply purchase real estate in your name and leave it at that. Not only are you exposing yourself to serious liability risks, but you’re running the risk of disorganization infecting your investments.

Limited Liability Corporations are a great option for structure – you just need to make sure you get your LLC done right. Let’s explore the steps necessary to get this done.

Pick a Name For Your LLC

This one shouldn’t be too difficult as long as you’re aware of Florida’s naming guidelines. Instead of picking just any name, Florida requires that your LLC title:

- Include “Limited Liability Company” or “LLC”

- Must be distinguishable from all other entities and filings with few exceptions

- Cannot imply it’s organized for a purpose other than what it’s being authorized for

- Cannot imply it’s connected to a state or federal government agency

“Bryant Taylor Properties” falls short of this requirement but “Bryant Taylor Properties LLC” would suffice. If we were forming a real estate LLC and went with “Bryant Taylor Cars LLC” then it would likely be declined as it implies a different purpose.

File Articles of Organization

After you’ve picked a name, your Articles of Organization must be filed with the Florida Division of Corporations. These articles will include basic information about your LLC, including:

- LLC name

- Principal address & mailing address

- Names of managers or authorized representatives (can be one or multiple)

- The name & signature of your Registered Agent

- The stated purpose of your organization

- Effect date

- Your name & email address

Beyond this, you can also request a certificate of status that verifies your LLC and a certified copy of your Articles of Organization, though neither of these is required.

Your Registered Agent can be an individual or an organization that serves as a registered agent. This can actually be you, but if you’re managing several properties it may be advisable to choose someone else to serve this role. The Registered Agent must adhere to the obligations defined in s.605.0113(3).

Additional steps

Once you’ve taken the above steps and paid your fees ($125 filing fee for LLCs in Florida) then your LLC is officially active. However, there are additional steps you should consider to add additional protection and organization to your Florida real estate investments.

An Operating Agreement is not required, but it will help define which members of your LLC have the authority to make certain decisions. This agreement should define the rules of engagement for each member and outline how instances of liability will be addressed and who will be responsible for addressing them.

Setting up separate bank accounts for your business, hiring or retaining an accountant for tax purposes, and updating your real estate documents to reflect the LLC as the owner are other important steps to take to get the most out of your LLC.

This can all be overwhelming and create surprising challenges along the way. Your best bet to get this right is to hire an attorney who can help you through the process of establishing your LLC and protecting your investments should issues arise down the line. Contact Bryant Taylor Law to make sure your business is protected and set up for success.

ventus

Latest posts by ventus (see all)

- The Role of a Business Attorney in Estate Planning - October 13, 2022